Venture Debt: 5 Reasons for its Rise in Indian Startups

🚀 Venture Debt: 5 Reasons for its Rise in Indian Startups

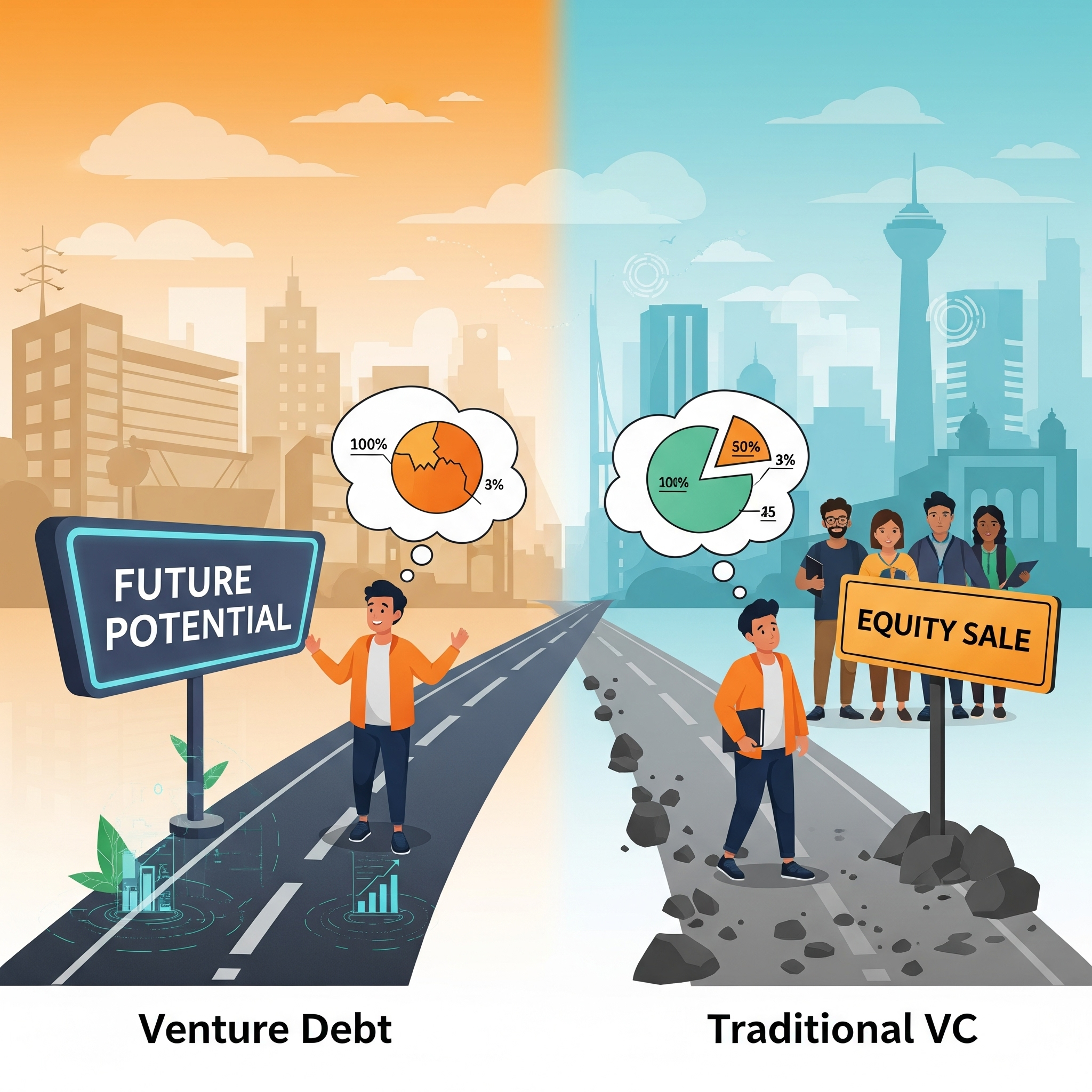

For years, the journey of an Indian startup was a binary choice: either bootstrap your way to profitability or raise venture capital (VC) by selling a piece of your company. But in 2025, that binary choice is a thing of the past. A powerful new financing option has emerged: venture debt. This is a type of loan designed specifically for high-growth, venture-backed companies, and it’s been hailed as a game-changer for a new generation of founders. Unlike traditional loans, venture debt is based on a startup’s future potential, not its current cash flow or physical assets. It’s a powerful tool that’s fueling growth, preserving equity, and creating a more flexible financing landscape for India’s booming startup ecosystem.

This blog post will explore five key reasons for the rise of venture debt in Indian startups. We’ll look at how this innovative financing option is helping founders navigate a more complex economic landscape and build more resilient and sustainable businesses.

1️⃣ Minimizing Equity Dilution for Founders 💼

One of the biggest advantages of venture debt is its ability to provide capital without a significant loss of ownership for founders. Traditional venture capital is a form of equity financing, which means that every time a startup raises a new round, the founders’ ownership stake is diluted. Venture debt, on the other hand, is a loan that must be repaid with interest. While lenders may receive warrants (the right to buy equity at a future date), the dilution is far less than it would be with a full equity round. This is a massive win for founders who want to retain more control and a larger ownership stake in their company.

✅ Benefits:

- Preserves Ownership: Founders and early employees retain a larger equity stake in the company.

- Higher Returns: A larger ownership stake can lead to a bigger financial payoff in the event of an exit.

- Maintains Control: Founders retain more control over the company’s strategic decisions.

- Reduces Cost of Capital: Venture debt can be a more cost-effective way to raise capital than a full equity round.

👉 How It Works: A Series A-funded startup needs an extra $2 million to hire a new team and accelerate its marketing efforts. Instead of raising a new equity round and giving up 10% of the company, the founders raise a $2 million venture debt loan. They pay a fixed interest rate, and the lender gets warrants to buy a small percentage of the company’s equity at a later date. This allows the founders to get the capital they need while minimizing the dilution of their ownership stake. For more on this, check out resources at inc42.com.

2️⃣ Extending the Cash Runway Between Funding Rounds ⏳

The fundraising process is time-consuming and often unpredictable. A startup may have a clear plan to raise its next round, but if it takes longer than expected, the company can run out of cash. Venture debt is a powerful tool for bridging this gap. It provides a startup with a “bridge loan” that can extend its cash runway by 6 to 12 months, giving the company more time to hit key milestones and increase its valuation for the next round. This is a crucial tool for founders who want to avoid a “down round”—a funding round at a lower valuation than the previous one—which can be a devastating blow to a company.

✅ Benefits:

- Avoids Down Rounds: You can get a bridge loan to avoid a funding round at a lower valuation.

- More Time to Grow: You have more time to hit key milestones and increase your company’s valuation.

- Reduced Fundraising Pressure: You can focus on building your business, not on endless fundraising meetings.

- Increased Flexibility: You can adapt to market trends and unexpected challenges without a funding crisis.

👉 How It Works: A startup is three months away from running out of cash, and its next funding round is taking longer than expected. The founders secure a venture debt loan that gives them an extra nine months of runway. This extra time allows them to hit their key milestones, and when they are ready to raise their next round, they can do so at a much higher valuation. For more on this, check out www.qapita.comQapita: #1 Rated Equity Management Software | CapTable, ESOPs ….

3️⃣ Fueling Strategic Growth Initiatives 🚀

Venture debt is not just a tool for survival; it’s a tool for growth. Startups can use venture debt to fuel a specific growth initiative, such as hiring a new sales team, launching a new product, or expanding into a new market. This is a more strategic and targeted use of capital than a full equity round, which is often used for a more general growth strategy. Venture debt allows a startup to be more agile and to take advantage of new opportunities as they arise, without the cost and complexity of a new equity round.

✅ Benefits:

- Targeted Capital: You can get capital for a specific growth initiative.

- Increased Agility: You can adapt to new market trends and opportunities as they arise.

- Competitive Edge: You can outpace competitors who are not using venture debt to accelerate their growth.

- Sustainable Growth: You can build a business that is both profitable and sustainable.

👉 How It Works: A B2B SaaS startup with a clear path to profitability wants to hire a new sales team to accelerate its growth. Instead of raising a new equity round, they secure a venture debt loan that is specifically for hiring. This allows the company to get the capital they need to hire a new team, which in turn generates more revenue and makes the company a more attractive investment for VCs. For more on this, check out www.svb.comSilicon Valley Bank – Banking for Innovation Economy

4️⃣ Leveraging VC Backing as a “Stamp of Approval” 🤝

Venture debt is not for every startup. Lenders are more willing to lend to a startup that has already secured venture capital funding. This is because a VC’s investment is seen as a “stamp of approval” that validates a startup’s business model and growth potential. Venture debt lenders are more interested in a startup’s ability to raise its next round of funding than its current cash flow, and a VC’s backing is a clear sign that a startup is on the right track. This creates a powerful synergy between venture capital and venture debt, with each one reinforcing the other.

✅ Benefits:

- Easier to Qualify: A VC’s backing makes it easier to qualify for a venture debt loan.

- Lower Interest Rates: A VC’s backing can lead to a lower interest rate on a venture debt loan.

- Strategic Partnerships: You can work with both a VC and a venture debt lender.

- Increased Investor Trust: A VC’s backing builds trust with venture debt lenders.

👉 How It Works: A startup that has just raised a Series A round from a top-tier VC firm decides to seek a venture debt loan. The venture debt lender, seeing the VC’s backing, is more confident in the startup’s potential and offers them a favorable loan with a low interest rate. This allows the startup to get the capital they need to grow, and it creates a new strategic partnership with the lender. For more on this, check out https://www.google.com/search?q=growthenterprise.com.

5️⃣ A New Era of Financial Flexibility for Startups 📈

The rise of venture debt in Indian startups is a clear sign that the financial landscape is becoming more flexible and founder-friendly. It provides a new tool for founders to build a business on their own terms, without being forced to give up too much ownership or be beholden to a rigid fundraising schedule. This is a fundamental shift from a one-size-fits-all approach to a more customized and strategic approach to financing. Venture debt is a powerful tool that’s empowering a new generation of founders to build a more resilient, sustainable, and profitable business.

✅ Benefits:

- Customized Financing: You can get a loan that is tailored to your specific needs.

- Flexibility: You can adapt to new market trends and opportunities as they arise.

- Control: You have more control over your business and your strategic decisions.

- Sustainable Growth: You can build a business that is both profitable and sustainable.

👉 How It Works: A new fintech startup has a strong product and a loyal user base, but it’s not yet profitable. The founders need an extra $1 million to scale their marketing efforts and achieve profitability. Instead of raising a new equity round and giving up ownership, they secure a venture debt loan. The loan is structured with an interest-only period, which gives them the flexibility to invest in their growth without the pressure of a full repayment schedule. For more on this, check out trifectacapital.in.

🌟 Why Venture Debt is a Game-Changer for Indian Startups

Venture debt is more than just a loan; it’s a strategic tool that’s empowering a new generation of Indian founders to build a more resilient and sustainable business. It’s a movement that’s bridging the gap between traditional banking and venture capital, creating a new era of financial flexibility and founder-friendliness.

📌 Conclusion

The era of a purely equity-based approach to startup financing is over. The future of financing is a strategic blend of venture capital and venture debt. By understanding and embracing these five principles, you can build a business that not only attracts investment but also creates real, lasting value.

👉 Explore more business and tech guides at yourspotlight.in