VC Trends 2025: 5 Ways Funding Has Changed for Startups

🚀 Venture Capital Trends 2025: 5 Ways Funding Has Changed

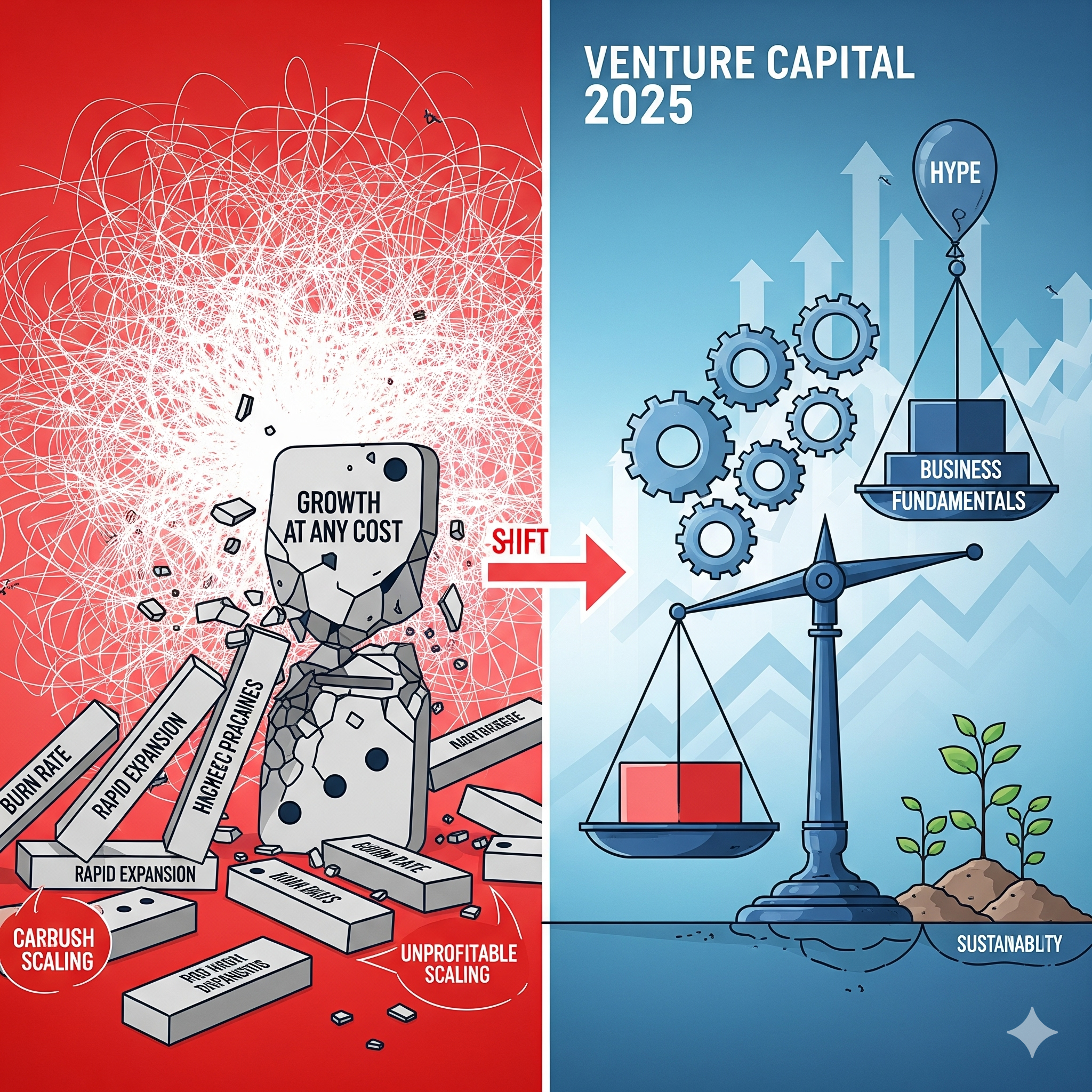

For years, the venture capital landscape was a high-stakes, fast-moving game. The motto was “growth at any cost,” and funding rounds were fueled by market hype and ambitious projections. But in 2025, a new reality has set in. The venture capital world is shifting, and investors are no longer writing blank checks. They are more cautious, more strategic, and more focused on the fundamentals of building a sustainable business. This is not a downturn; it’s a recalibration. For founders, it means that the old playbook for fundraising is dead, and a new, more disciplined approach is required.

This blog post will explore five key trends that are shaping the venture capital landscape in 2025. We’ll look at what investors are now looking for, and what you, as a founder, need to do to secure funding in this new era of startup finance.

1️⃣ Profitability over Hyper-Growth 💰

The most significant shift in venture capital is a change in mindset from “growth at all costs” to a focus on a clear path to profitability. In the past, VCs would tolerate a high burn rate and a lack of revenue if a startup showed rapid user growth. In 2025, the narrative has flipped. Investors are now looking for businesses with sound unit economics, healthy profit margins, and a clear, sustainable business model. This means that a startup with a solid revenue stream and a plan to scale profitably is now more attractive than a company with a massive user base and no clear path to making money.

✅ Benefits:

- Sustainable Growth: Building a business on profit makes it more resilient to market downturns.

- Capital Discipline: A focus on profitability encourages founders to be more mindful of their spending.

- Increased Investor Trust: A clear path to profit builds confidence with VCs.

- Stronger Business Fundamentals: Focus on a strong business model, not just a flashy idea.

👉 How It Works: A new SaaS startup is pitching to a VC firm. Instead of just showing their user growth numbers, they present a detailed financial model that shows a clear path to profitability in three years. They highlight their low customer acquisition cost (CAC), high customer lifetime value (LTV), and a strong profit margin. This disciplined, data-driven approach convinces the investors that the company has a sustainable business model and is a safer investment. For more on this, check out resources at deloitte.com.

2️⃣ AI Dominance with a Caveat 🤖

AI remains the hottest sector in venture capital, but the way investors are approaching it has matured. In 2025, it’s not enough to simply say your company uses “AI.” Investors are now looking for “AI-native” solutions that are fundamentally built on AI and solve a real problem. They are also looking for startups that have a clear revenue model and a path to profitability, not just a product that is “cool.” The focus is shifting from generic AI tools to vertical AI solutions that are tailored to specific industries like healthcare, finance, and agriculture. This is a move from chasing a trend to investing in a technology that can create real, lasting value.

✅ Benefits:

- Targeted Investment: You can find investors who are specifically looking for AI startups.

- Higher Valuations: AI startups continue to command high valuations and large deals.

- Real-World Impact: Your business can solve a real problem for a specific industry.

- Market Leadership: You can become a leader in a new, high-growth sector.

👉 How It Works: A startup develops an AI-powered tool for the healthcare industry that helps doctors diagnose rare diseases. The tool uses a large dataset of patient records and a deep learning model to provide doctors with a more accurate diagnosis. The company’s clear value proposition and a strong, industry-specific revenue model make it an attractive investment for VCs who are looking for AI solutions with a real-world impact. For more on this, visit weforum.org.

3️⃣ The Era of “Megadeals” and Fewer, Larger Rounds 📈

While the total number of VC deals has declined, the value of individual deals has skyrocketed. 2025 is becoming the era of the “megadeal,” with a small number of startups raising a massive amount of capital. This trend is a clear sign that VCs are becoming more selective in their investments. They are writing fewer checks but making them bigger, pouring a massive amount of capital into a handful of companies they believe will be the market leaders. For a founder, this means that the fundraising process is slower and more rigorous, but the payoff, if you can get it, is massive.

✅ Benefits:

- More Capital: You can raise a massive amount of capital to fuel your growth.

- Reduced Time on Fundraising: You can focus on building your business, not on endless fundraising meetings.

- Market Leadership: A large funding round can establish you as a leader in your market.

- Increased Investor Confidence: A large deal signals to the market that your business is a serious player.

👉 How It Works: A new AI startup has a promising product and a clear path to profitability. They spend a year building their product and their team, and they are now ready to raise their Series B. They pitch to a small number of top-tier VCs, and after a rigorous due diligence process, they close a $50 million round. This large deal allows them to scale their business globally and establish themselves as a market leader. For more on this, check out techcrunch.com.

4️⃣ The Rebound of IPOs and Exit Markets 🔄

After a few years of a sluggish IPO market, there is a cautious optimism that IPOs and exit markets are making a comeback in 2025. This is great news for both VCs and founders, as a healthy exit market is the ultimate goal of any startup. This rebound is being driven by a combination of factors, including a more stable economic environment and a new generation of tech companies that have a clear path to profitability. This is a clear signal that the venture capital ecosystem is normalizing, and that the long-term prospects for startups are looking up.

✅ Benefits:

- Clear Exit Strategy: A healthy IPO market provides a clear path for a successful exit.

- Increased Investor Confidence: A strong exit market makes VCs more willing to invest in new companies.

- Liquidity for Founders: An IPO can provide liquidity for founders and early employees.

- Market Validation: A successful IPO is a powerful signal that your business is a leader in your market.

👉 How It Works: A high-growth tech startup with a clear path to profitability decides to go public. They work with a team of advisors to prepare for their IPO, and after a successful launch, their stock is listed on the NASDAQ. This successful exit provides a massive return for their investors and provides liquidity for the founders and employees who helped build the business. For more on this, visit www.nasdaq.comNasdaq: Stock Market, Data Updates, Reports & News

5️⃣ Capital Efficiency and Smart Spending 💼

In the new venture capital era, capital efficiency is the new metric for success. In the past, VCs would reward startups that “burned” through capital to achieve growth. In 2025, VCs are looking for founders who can demonstrate that they can achieve growth with a lean and efficient business model. This means building a business that can generate revenue with a small amount of capital, focusing on a strong product, and a sustainable business model. The focus is shifting from a “grow at any cost” mentality to a “build a great business” approach that is both profitable and sustainable.

✅ Benefits:

- More Control: A focus on capital efficiency gives founders more control over their business.

- Longer Runway: You can operate for a longer period of time with less capital.

- Increased Investor Confidence: A focus on efficiency signals that you are a responsible leader.

- Sustainable Growth: A lean business model is more resilient to market downturns.

👉 How It Works: A new startup is raising its seed round. The founders present a detailed financial model that shows how they plan to achieve a significant amount of revenue with a very small amount of capital. They highlight their lean team, their low marketing costs, and their focus on a sustainable business model. This disciplined, efficient approach convinces the investors that the founders are responsible leaders who can build a great business. For more on this, check out www.ycombinator.comY Combinator

🌟 Why Venture Capital Trends Matter to Your Business

The venture capital landscape is a direct reflection of the broader economic and technological trends of our time. By understanding these shifts, you can better position your startup for success. The new era of venture capital is not about who can grow the fastest; it’s about who can build the most sustainable, profitable, and valuable business.

📌 Conclusion

The old rules of fundraising are over. The new era of venture capital is a challenge, but it’s also a tremendous opportunity. By understanding and embracing these five principles, you can build a business that not only attracts investment but also creates real, lasting value.

👉 Explore more business and tech guides at yourspotlight.in